Car Accident and Personal Injury Law

What Is The Role of A Car Accident Lawyer?

A car accident lawyer and personal injury attorney specialize in accident law, assisting victims of car crashes, auto accidents, and vehicle accidents. They handle claims for car accidents, personal injury cases, and auto accident lawsuits, addressing injuries, including brain injuries, disfigurement, and physical trauma. Lawyers and attorneys guide clients through car accident law, providing consultations to resolve injury claims and disputes with insurance companies. They help recover damages, such as medical bills, wages, and property damage, caused by collisions, crashes, or negligence. Law firms represent drivers, passengers, and pedestrians, navigating torts, liability, and responsibility to secure settlements or favorable verdicts. With expertise in personal injury law, they address fault, advocate for victims’ rights, and ensure justice in court for auto accident claims, traffic crashes, and motor vehicle accidents. From bicycle accidents to truck accidents, they handle injury cases caused by speeding, road conditions, or other factors, achieving results for families facing losses and fatalities.

The best law firms provide representation for accident victims, addressing whiplash, disability, and emotional suffering caused by car accident cases. They work with insurance adjusters to resolve accident claims, offering solutions for costs, exceptions, and deadlines. Handling product liability, traffic accidents, and truck collisions, these firms ensure justice for plaintiffs through jury trials, negotiations, and verdicts. From light impact collisions to severe fatalities, they assist with personal injury claims, emphasizing the importance of evidence and expert advice. Their track record includes addressing system flaws, offering options, and achieving favorable outcomes for clients, families, and their loved ones.

Key Questions to Ask Witnesses in an Auto Accident

In the unfortunate event of a car accident, vehicle accident, or auto accident, collecting accurate and detailed information from the scene is vital for addressing legal claims, navigating insurance company disputes, and determining liability. One crucial step is engaging with witnesses present at the site of the collision, wreck, or crash, as their accounts can serve as critical evidence in a car accident claim or personal injury case. Asking the right questions ensures a clear understanding of the events leading to the accident while helping to establish fault and support your personal injury claim. At Law Circle, we understand the challenges victims face after auto accidents, car crashes, or other traffic accidents, and we provide expert guidance on the essential questions to ask witnesses. Whether you are dealing with insurance companies, pursuing compensation for injuries, or working with a car accident lawyer or personal injury attorney, having the right information can make all the difference in achieving a favorable outcome.

Ask the witness for their contact information, including their phone number and email address, as this is essential for following up on any questions or details regarding the car accident, auto accident, or collision. Obtaining this information ensures you can reach them later if clarifications are required for your car accident claim, personal injury claim, or discussions with your lawyer, attorney, or insurance company. Additionally, inquire about whether they noted the vehicle registration, recorded any footage, or took photos at the scene of the crash, as these can significantly strengthen your evidence for handling legal matters or disputes with insurance companies.

Next, inquire about the exact time and date of the accident, as these details contribute significantly to the accuracy of your report. Ask witnesses what they observed concerning the position and speed of each vehicle involved before and during the collision. Inquiring whether they heard any horns or found any behavior by drivers unusual might provide useful insights.

Understanding the environment is also key. Ask witnesses to describe the weather conditions at the time of the accident, as well as the brightness or visibility on the road. Confirmation of the road conditions, whether wet, dry, or icy, factors into the overall understanding of the incident and can help determine who was liable.

Further, posing questions about the actions of other motorists and pedestrians, as observed by the witness, can shed light on potential negligence or adherence to traffic laws. Witnesses can detail if they perceived any distractions from the driver, such as mobile phone usage or erratic lane changes, potentially crucial in a personal injury claim scenario.

Finally, ask about any sounds they overheard before, during, and after the accident, as this auditory information may be pivotal in recreating the series of events accurately. It's essential to handle these inquiries thoughtfully and document their responses comprehensively in readiness for discussions with your legal or insurance representatives.

Keep in mind that Law Circle provides personalized, professional guidance on how to effectively gather and manage accident information, ensuring you have the necessary tools for building a robust personal injury claim.

How Do I File a Car Insurance Claim and Handle Denials?

After a car accident, navigating the process of filing a car insurance claim can be daunting. To start, it's critical to contact your insurance company immediately, providing them with all necessary information about the accident. Your insurance agent will guide you through the specific steps required by your policy, outlining the details needed to process your claim. These typically include photographs of the accident scene, contact information of any witnesses, a police report, and any relevant medical records if injuries occurred.

The next step involves understanding your coverage details. It’s important to know the extent of your coverage to anticipate what your insurance company might offer in terms of compensation for property damage or medical expenses. Your insurance company will assign a claims adjuster to your case, who will assess the accident's particulars and determine liability. At this point, providing comprehensive and accurate information can significantly affect the outcome of your claim.

If your insurance company denies your claim, it's advisable to carefully review the denial letter. Often, denials are based on insufficient documentation or misunderstandings related to your policy details. In such cases, clarify the reasons behind the denial with your insurance agent and provide additional evidence if needed. Should the issue persist, consider seeking a free consultation from a legal expert to discuss your case and explore your options. Engaging a professional can be invaluable, especially when navigating complex issues such as policy discrepancies or ambiguous coverage terms.

Throughout this process, communication with your insurance company is vital. Keep a record of all calls and correspondence related to your claim. This documentation can be beneficial should further disputes arise. For those facing significant challenges in handling a denial, consulting with a personal injury lawyer, like the experts at Law Circle, may offer the support you need in strengthening your case. Lawyers can assist with the appeal process by providing insights on insurance policies and advocating on your behalf should negotiations with the insurance company falter.

In conclusion, promptly filing your car insurance claim following an accident and subsequently handling any denials with diligence is crucial. Staying informed about your specific insurance policy, leveraging available resources like free consultations, and knowing your rights are all keys to resolving your insurance claim effectively. Should complexities arise, seeking legal advice may prevent further delays, ensuring your vehicle repair and medical expenses are rightly addressed. Remember, gaining clarity on accident questions and insurance matters can significantly influence the resolution of your claim.

How Can a Personal Injury Lawyer Assist with Your Claim?

After being involved in auto accidents, seeking assistance from a personal injury lawyer significantly enhances your ability to navigate the complexities of a personal injury claim. A qualified injury lawyer will play a crucial role in ensuring that you fully understand your legal rights and entitlements following an accident. Their initial step involves offering a free consultation where they will collect all pertinent information about the accidents, allowing them to better assess the viability of your case. During this meeting, they will discuss the details of the injury and advise on the next steps to take in your claims process.

One of the primary advantages of consulting with a lawyer is their ability to determine the full value of your claim. This involves analyzing medical records, accident reports, witness statements, and other relevant information related to your case. A personal injury lawyer is well-versed in identifying various forms of compensation that you might be entitled to, such as medical expenses, lost wages, and pain and suffering arising from your injuries. Furthermore, they facilitate communication with the insurance companies, ensuring that evidence supporting your claim is well-documented and presented.

Attorneys also play a pivotal role when handling cases that involve negotiating settlements or taking the case to court. A personal injury lawyer will utilize their expertise to negotiate with insurance companies to achieve a fair settlement. If negotiations do not result in a satisfactory offer, they are prepared to litigate on your behalf. This ensures that you have professional representation at all stages of your claim, reinforcing your position. Contacting a lawyer promptly after your accidents is paramount as there might be statutory limitations impacting the period within which you can file your claim.

Additionally, injury lawyers have the capacity to address any complications that may arise if your initial claim is denied by the insurance company. They have the acumen required to challenge denials and will work to ensure that all necessary information is included to make a compelling case on your behalf. By leveraging their understanding of the legal landscape, a personal injury lawyer offers invaluable assistance, transforming an otherwise overwhelming process into a structured pathway to securing the compensation you deserve. Being informed about the support they offer empowers you to make well-founded decisions regarding your legal standing.

What Types of Compensation Can I Receive for an Injury?

Determining what types of compensation you can receive for an injury following a car accident is crucial to understanding your rights and ensuring you are adequately covered. After such an accident, you may be eligible to file a personal injury claim to seek compensation for various kinds of damages. The primary type of compensation typically revolves around covering medical expenses related to the injury sustained in the accident. These expenses can include emergency room visits, surgeries, rehabilitation, and any long-term treatment necessary for recovery from your injuries. In addition to medical costs, another form of compensation involves reimbursing lost wages.

If the injury causes you to take time off work, whether temporarily or permanently, you may be able to claim lost income due to the accident. Furthermore, compensation can also cover non-economic damages such as pain and suffering experienced as a result of the injuries incurred. It’s important to note that personal injury claims can vary significantly based on the specifics of the case, the extent of the injury, and the coverage you have under your insurance policy. Insurance coverage plays a pivotal role in determining what kinds of compensation are available, and having a comprehensive policy can significantly impact the outcome of your claim. After an accident, it's essential to contact a personal injury lawyer who can assist in assessing your case, gathering the necessary personal information, and navigating the often-complex insurance claim process. A qualified personal injury lawyer can help you understand who is liable for the accident, which directly affects your compensation potential. The liability will depend on various factors, including evidence gathered from the scene and statements from witnesses. Engaging with an attorney can ensure that your rights are protected, and you receive fair compensation. Additionally, they will provide guidance on how to handle any denials from the insurance company if they arise. Remember, every case is unique, and consulting with a seasoned personal injury lawyer will provide clarity on the best course of action. At Law Circle, we prioritize your recovery and strive to safeguard your interests post-accident. By understanding the different types of compensation, you’re one step closer to securing the rightful damages you're entitled to following a car accident.

Steps to Take for Car Repair and Insurance Evaluation

After experiencing an auto accident, vehicle repair and insurance evaluation become immediate concerns. It’s imperative to determine the extent of damage to your car and initiate contact with your insurance company as soon as possible. Begin by gathering all pertinent information about your automobile, including your policy details and license information. Take photographs to document the damage to your vehicle and any other vehicles involved. These images serve as essential evidence when communicating with your insurance agent and the insurance company.

Once you’ve collected the necessary information, contact your insurance company to report the incident. During this call, it's important to provide them with the specifics of your auto accident, relay the collected evidence, and clarify any doubts related to your insurance policy. The insurance company may assign you an agent who will walk you through the process of making a claim. This step is crucial for determining what repair costs your policy covers. Don't hesitate to ask any questions that will help you understand your coverage and how to proceed with vehicle repairs.

After you've spoken with your insurance company, begin researching repair services known for providing high-quality car and vehicle repair. Consider scheduling a consultation with a trusted service provider to obtain a free estimate of the repair costs. Inquire about the availability and sourcing of replacement parts required for your automobile. During this phase, keep all lines of communication open between the repair service and your insurance company to ensure that the repair work aligns with your policy’s coverage. This collaboration helps in efficiently processing your claim as you proceed with restoring your car.

Additionally, some insurance agents may recommend authorized repair shops that work directly with your insurance provider, simplifying the repair and evaluation process. Confirm whether proceeding with one of these repair shops benefits your situation in terms of cost and convenience. Throughout the entire process, document every interaction and maintain records, including correspondence, bills, and evaluations, to support your claims if discrepancies arise later.

Communicating effectively with all involved parties, from the repair shop to the insurance company, can significantly reduce the stress associated with a car accident. By following these steps, you ensure a smoother repair and evaluation process, eventually bringing your vehicle back to its original state. Taking prompt action in contacting your insurance and understanding your policy thoroughly pays off in the long run, alleviating the challenging aftermath of an auto accident.

Recent Post

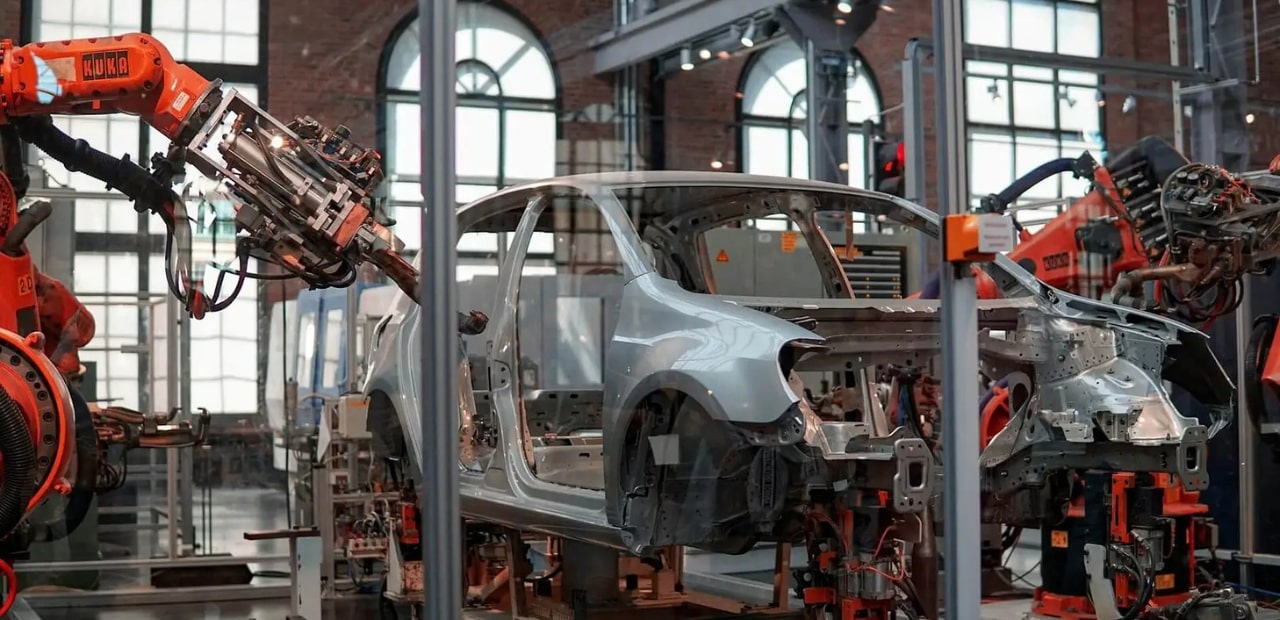

Can we sue the manufacturer if a vehicle malfunction contributed to the accident?

When it comes to vehicle accidents caused by malfunctions, understanding liability is crucial. In these cases...

What steps should I take immediately following the collision to ensure the best legal outcome?

When an incident occurs, it is crucial to report it promptly and accurately. The first step in reporting the incident is to...

How do you determine the value of my claim and potential settlement amount?

Sustaining an injury can be a traumatic and life-altering event. It is crucial to thoroughly evaluate the nature and severity

Need Legal Services?

Law Circle Car Accident and Personal Injury Questions

1321 Heron St., Boise, Idaho, 83702 USA

Email us at [email protected]